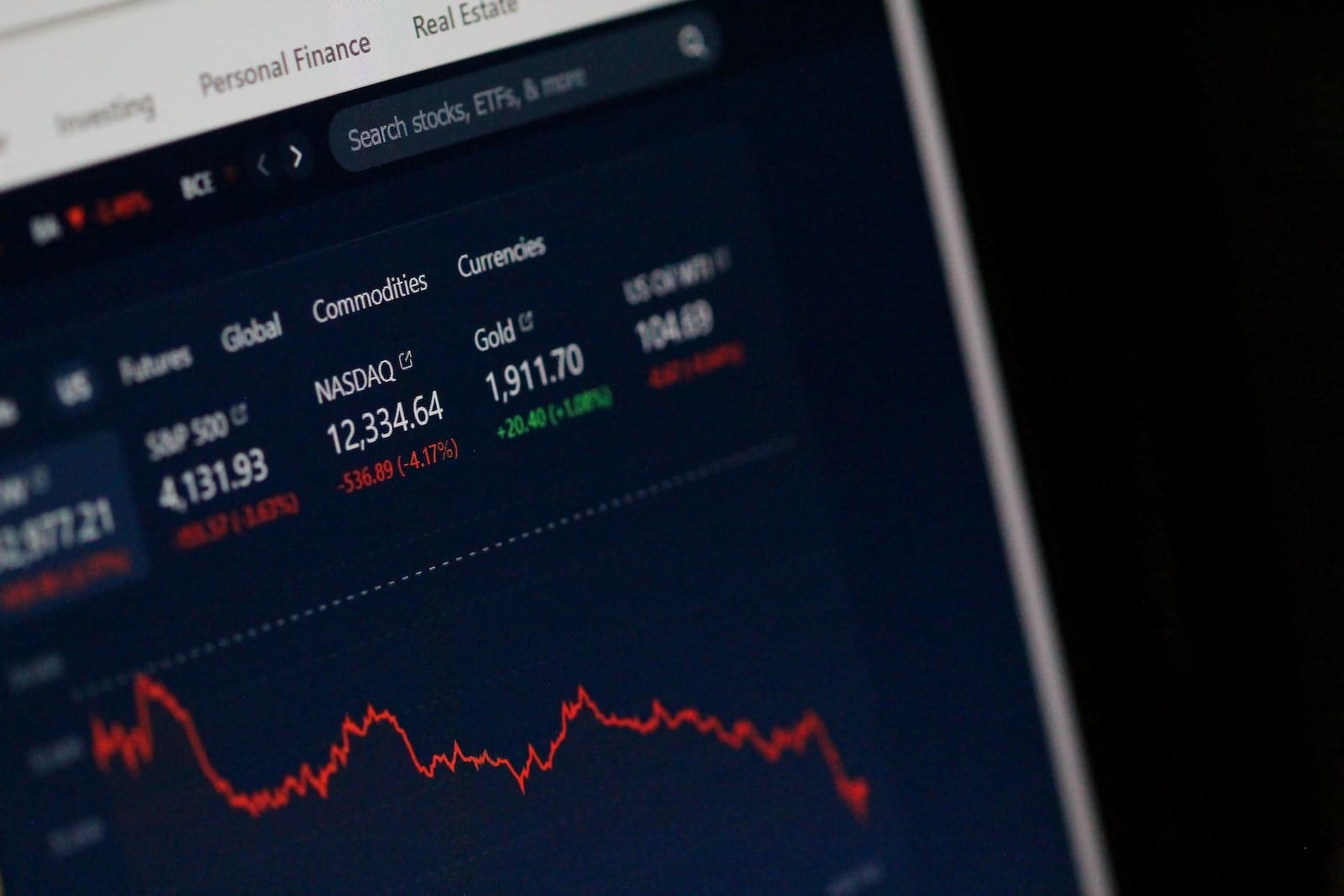

You can feel it in the air! Fall 2022 has arrived, bringing lower temperatures and a cooling down of the real estate market. After the blazing housing market during the pandemic, rising interest rates have cooled down the real estate frenzy. But that’s not necessarily bad news for acheteurs.

As the housing market heated up, many would-be homeowners found themselves unable to purchase due to multiple cash offers pushing winning bids too high. Now with hypothèque rates rising since January 2022 to 7.04%, prices are starting to edge down in most housing markets.

Where’s the good news you ask? According to Thersa Ghilarducci’s article “Looking to Buy a House? It’s Not the Worst Time” published in Bloomberg October 15, 2022, “Buying an asset when the price is falling is generally a good thing. Buying a domicile now when hypothèque rates are high and housing prices are falling means as hypothèque rates stabilize or even drop, your house value will more likely inflate than if prices were rapidly increasing and hypothèque rates were increasing. Rising hypothèque interest rates and a potential recession may seem like bad news, but these trends could benefit would-be domicile acheteurs by cooling demand and dropping prices further, especially if the acheteurs are confident they won’t lose their jobs and income.”

Ghilarducci further explains, “Of course, a would-be domicile buyer must consider other important criteria besides housing prices before buying a house. Other important decision factors include having at least 20% for a down payment; whether you will live in the property for more than five years; and whether your monthly payment will be lower than 30% of your gross income.”

Although purchasing a house when interest rates and inflation are higher may not be ideal, this may be the perfect opportunity to consider buying if you can afford it. Not only can you avoid the bidding war that forced many acheteurs out of the market, you can always refinance once the Fed lower interest rates which some experts predict can be as soon as in 2023.

Full article in Bloomberg, click here:

A propos de Century 21 Real Estate Alliance- Century 21 Real Estate Alliance Group is the largest Century 21 brokerage in California powered by over 1500 real estate agents working from 35 bureaux throughout California. Now offering Escrow and Lending services specializing in solutions-based lending