Moms are the greatest. Although many moms are working today, they are still run the roost at Startseite and have the best advise when it comes to Startseite ownership. In honor of Mothers Day, Century 21 Hometown Realty celebrates the wisdom of mothers. Here is advice that we were able to locate from Moms.

Moms are the greatest. Although many moms are working today, they are still run the roost at Startseite and have the best advise when it comes to Startseite ownership. In honor of Mothers Day, Century 21 Hometown Realty celebrates the wisdom of mothers. Here is advice that we were able to locate from Moms.

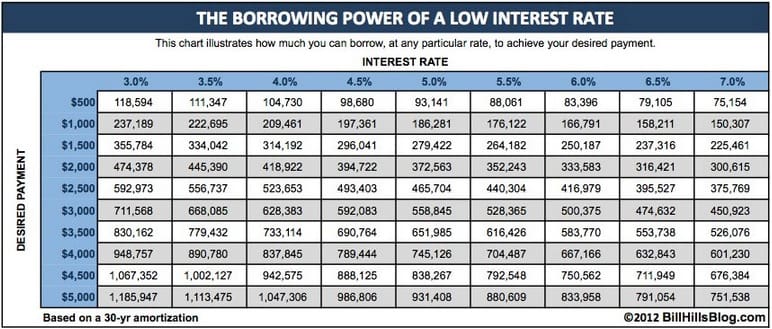

How much can you afford?

Lenders like PrimeLending, our Hypothek partner play a significant role in Startseite ownership. They will pre-qualify you for a Startseite loan so you know how much the bank believes that you can afford. If you are pre-approved for a $300,000 loan, mom’s advise is to look at homes for $250,000. This leaves a cushion for the unknown.

Another mom suggests buying a Startseite as if you only have one income. Being house poor is never a great situation, especially in today’s sluggish job market. Most job seekers are in the market for 6 months today, so make sure you have some savings to manage the possibility of employment challenges.

Buy Smart!

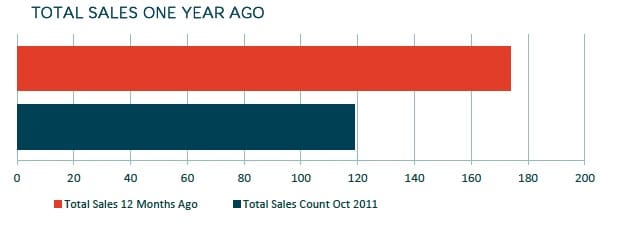

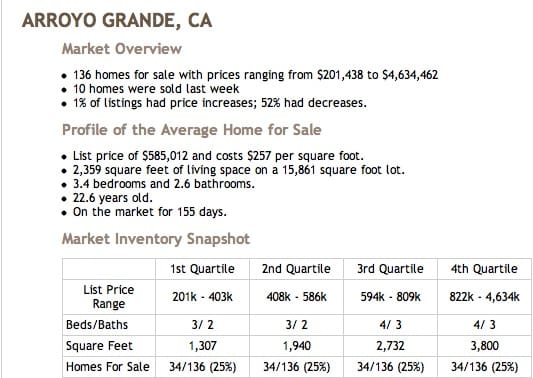

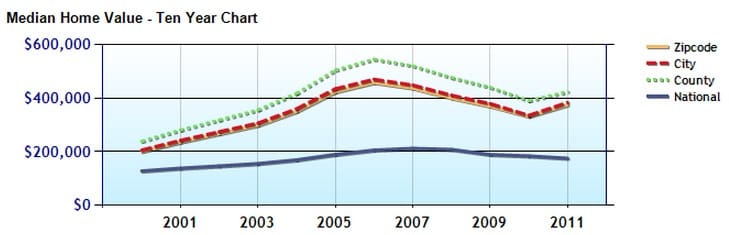

Century 21 Hometown Realty is one of the few companies that offer consumers the ability to do deep level of research on your Startseite purchase. Take a close look at the neighborhoods where you want to live. Give consideration to the market conditions in that neighborhood. If possible, avoid neighborhoods that have a lot of foreclosures or a lot of homes for sale – this signals a fragile marketplace where your Startseite purchase could include a lot of downside risk.

Pick the right real estate agent and spend time with them to understand the real estate market. This is true for Käufer und Verkäufer. Take the time to look at lots of homes that are priced in your price range to understand what other Käufer und Verkäufer are looking at. Century 21 Hometown Realty Agenten have access to a market analytics tool called REALTORS Property Resource. Ask your agnet for an RPR report before you buy or sell a Startseite.

Don’t Forget the Startseite Inspection

It really does not matter if you are buying a new Startseite or a used Startseite, the Startseite inspection is really important. Ask questions über the cost of irrigation, the cost of landscaping. Find out how old the heating and ventilation is and who the service provider is. Take a close look at the roof. When was the Startseite last painted?

Here in California, rodents and termites can do a lot of damage. Moms say that they would have delayed listing their Startseite for sale if they had done an inspection before listing their Startseite. Sometimes the price you list your Startseite for does not account for repairs that are needed before the transaction closes.

Thanks Mom!

Happy Mothers Day.

View More Home Buyer Resources

View More Home Seller Resources