CENTURY 21 Real Estate Alliance joins forces with CENTURY 21 Masters . We are stronger together! Learn More

Is the list price the sales price

Century 21 Hometown Realty has 300 properties for sale in company inventory today. There are about 1000 single family homes listed in the region. The top 10 brokerages in CCRMLS combined to sell about 400 homes. Century 21 Hometown sold around 100. By all accounts, the county only has two to three months of inventory. If you are searching for a home in a specific town or for a specific price, you will find that your selection is very low. For example, there are only 12 Single Family Homes priced between $350,000 and $450,000 at the time of this article. If you have your hopes on a three bedroom, two car garage and a fireplace, there are only 4.

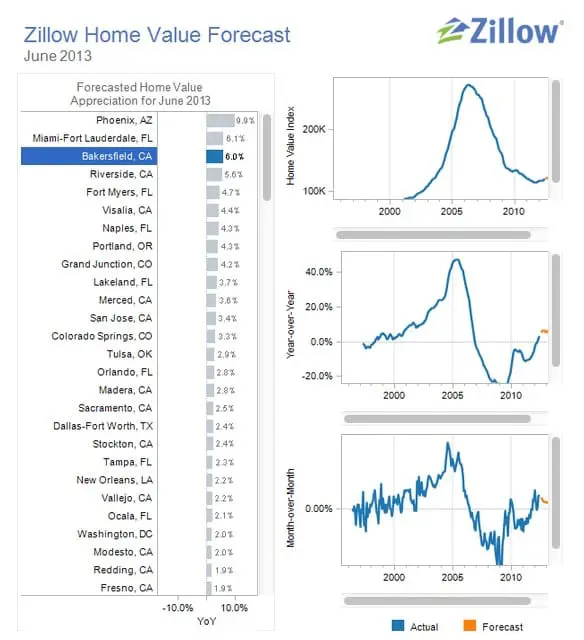

Century 21 Hometown Realty has 300 properties for sale in company inventory today. There are about 1000 single family homes listed in the region. The top 10 brokerages in CCRMLS combined to sell about 400 homes. Century 21 Hometown sold around 100. By all accounts, the county only has two to three months of inventory. If you are searching for a home in a specific town or for a specific price, you will find that your selection is very low. For example, there are only 12 Single Family Homes priced between $350,000 and $450,000 at the time of this article. If you have your hopes on a three bedroom, two car garage and a fireplace, there are only 4.

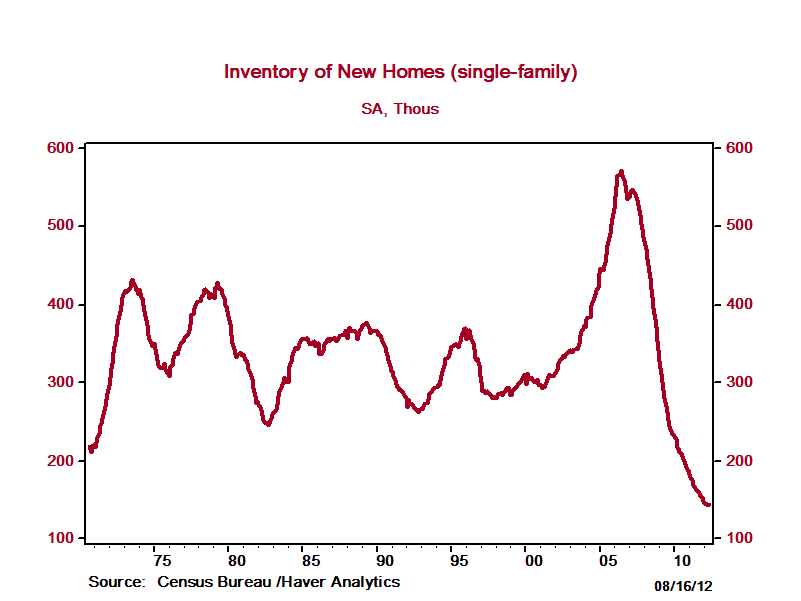

The issue of low inventory is that it puts upward pressure on pricing. As you can imaging, if there are 20 families looking for the type of home that only has 4 matches, offers typically come in at or above the list price. You would think that if you make a cash offer with no contingencies and agree to pay list price for a home, the seller can’t say no. A recent court case says otherwise.

RealPro, Inc. v. Smith Residual Co., LLC (2012)

In RealPro, Inc. v. Smith Residual Co., the seller placed a desirable lot of land on the market. An aggressive buyer quickly offered to purchase the lot exactly as listed – all cash without any contingencies. Upon receipt of the buyer’s offer, the seller countered at a higher price. Negotiations broke down and the buyer walked away.

The buyer’s agent filed a lawsuit against the seller claiming that the seller is compelled by the listing agreement to sell the home at the price offered. The buyer’s agent reasoned that the seller unreasonably refused a buyer who seemed to match the seller’s original criteria. The court rejected this argument.

Exclusive Listing Agreements

When you list a home with Century 21 Hometown Realty or any other brokerage, you enter into an Exclusive Listing Agreement. Every ELA includes a section for your agent to enter a minimum list price for the property. However, this is more of a marketing authorization by the seller and less of a minimum sales threshold. Most form ELA’s have the clause “…or at other terms acceptable by the Seller” immediately following the space for the list price. This allows the agreement to remain valid if the property sells above or below listing price because the sale was on “other terms acceptable to the Seller.”

In RealPro, the court found that the buyer’s agent had not produced an offer that was “acceptable to the seller.”

Therefore, homebuyers should never expect that the initial list price is binding on the seller. Listing agreements simply authorize the listing agent to market the property and solicit offers for the benefit of the seller. The terms assented to by the seller in the purchase agreement are the acceptable terms which obligate payment to the real estate agents.

Homebuyer Tips

The best thing that you can do to increase the likelihood of getting your offer accepted is to get pre-qualified for a mortgage. Century 21 Hometown Realty has an affiliated mortgage partner in Prime Lending.

List your home with Century 21

Century 21 Hometown has more buyers than properties for sale today. If you do not know a Century 21 Hometown Agent already, please feel free to call any of our offices and ask for the office manager. The office managers’ name is listed under each of our offices. Select the Meet our Agents link along side any office listed here.

Top 10 Area Brokerages by Unit Volume in July